Is Shopify Capital Loan Right for Small Businesses? sets the stage for this engaging exploration, providing readers with a comprehensive look at the topic in a style that is both informative and captivating.

The following paragraphs will delve into the specifics of Shopify Capital Loan and its impact on small businesses.

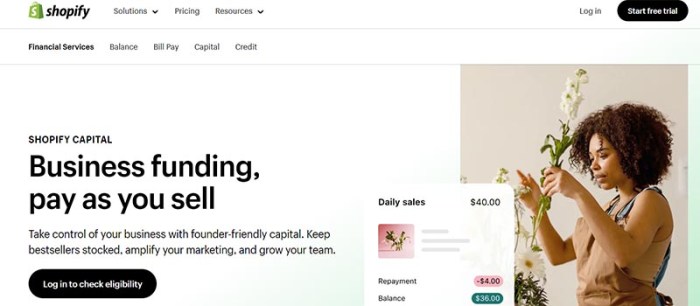

Overview of Shopify Capital Loan

Shopify Capital Loan is a financing option offered by Shopify to help small businesses grow and expand their operations. It provides eligible businesses with a lump sum of money that is repaid using a percentage of daily sales made through the Shopify platform.

Eligibility Criteria for Small Businesses

- Must be a Shopify merchant with a minimum of 9 months in business

- Minimum annual revenue threshold

- Good standing with Shopify (e.g., no outstanding chargebacks)

Benefits of Shopify Capital Loan for Small Businesses

- Quick and easy application process

- No fixed monthly payments, repayment is based on a percentage of daily sales

- No credit checks or personal guarantees required

- Funds can be used for various business purposes like inventory, marketing, or equipment

Understanding the Application Process

When considering applying for a Shopify Capital Loan, it is important to understand the steps involved in the application process, the documentation required, as well as the timeline for approval and disbursement of funds.

Application Steps

- Create a Shopify account if you don't have one already.

- Visit the Shopify Capital page and click on the "Get started" button.

- Fill out the application form with details about your business, revenue, and funding needs.

- Submit the application and wait for a decision from Shopify.

Documentation Required

- Proof of identity (e.g., driver's license, passport).

- Proof of business ownership (e.g., business license, articles of incorporation).

- Bank statements and financial documents to support revenue claims.

- Information about your online store and sales history on Shopify.

Approval and Disbursement Timeline

- Approval times can vary but typically range from a few days to a couple of weeks.

- Once approved, funds are usually disbursed directly into your business bank account within a few business days.

- The repayment terms will be Artikeld in the loan agreement, along with any fees or interest rates.

Loan Amounts and Terms

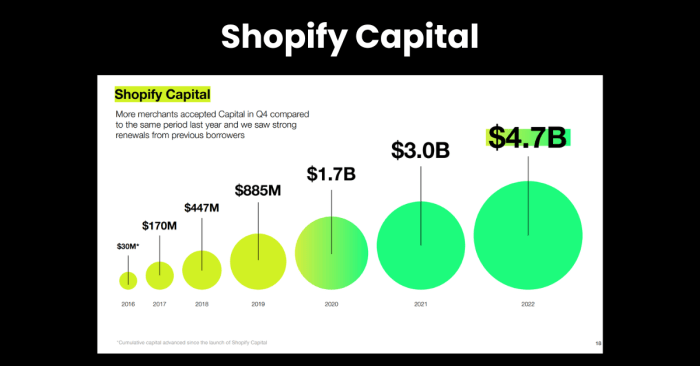

When it comes to Shopify Capital Loans, understanding the loan amounts offered and the associated terms is crucial for small businesses looking for financial support.

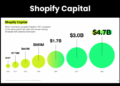

Loan Amounts Offered

- Shopify Capital offers loan amounts ranging from $200 to $2,000,000, depending on the business's sales history and financial health.

- The loan amount is determined based on the business's performance on the Shopify platform, such as revenue and sales trends.

Repayment Terms and Conditions

- Repayment terms for Shopify Capital Loans are flexible and vary based on the business's daily sales volume.

- Instead of fixed monthly payments, repayments are made by deducting a percentage of daily sales, making it easier for businesses during slow periods.

- There are no deadlines for repayment, as the loan is repaid automatically as a percentage of daily sales until the total amount is settled.

Interest Rates Comparison

- Shopify Capital Loans typically have higher interest rates than traditional bank loans, as they are designed to be more accessible and have less stringent eligibility criteria.

- While traditional bank loans may offer lower interest rates, they often require extensive documentation and have stricter approval processes, making them less suitable for small businesses in need of quick funding.

- Shopify Capital Loans provide a faster and more streamlined application process, making them a viable option for small businesses looking for immediate financial support.

Impact on Small Businesses

Shopify Capital Loans can have a significant impact on small businesses, providing them with the financial support needed to grow and expand their operations. These loans can help businesses increase inventory, launch marketing campaigns, improve their online presence, or even hire additional staff to meet increased demand.

Success Stories and Case Studies

- One small boutique clothing store used a Shopify Capital Loan to invest in new inventory and launch an online store, resulting in a 50% increase in sales within the first year.

- A small family-owned bakery utilized a Shopify Capital Loan to upgrade their equipment and expand their product offerings, leading to a 30% growth in revenue.

- Another example is a handmade jewelry business that used the loan to attend a major trade show and secure new wholesale accounts, ultimately doubling their customer base.

Potential Risks and Drawbacks

- One drawback of taking a Shopify Capital Loan is the risk of overextending the business financially, especially if the repayment terms are not carefully considered.

- Business owners should also be aware of the impact of loan repayments on their cash flow, as failing to make timely payments could lead to additional fees or even default.

- Additionally, while Shopify Capital Loans can provide quick access to funds, businesses should evaluate whether the loan amount and terms align with their long-term growth plans to avoid unnecessary debt.

Ending Remarks

In conclusion, Is Shopify Capital Loan Right for Small Businesses? offers a nuanced understanding of this financial option, highlighting both its benefits and potential drawbacks.

Q&A

Is there a minimum credit score required to apply for a Shopify Capital Loan?

The eligibility criteria for a Shopify Capital Loan do not specify a minimum credit score. Shopify considers various factors beyond credit score when evaluating applications.

What are the typical repayment terms for a Shopify Capital Loan?

Repayment terms for a Shopify Capital Loan are based on a percentage of daily sales through the Shopify platform, making it flexible for businesses.

Are there any prepayment penalties associated with Shopify Capital Loans?

Shopify Capital Loans do not have prepayment penalties, allowing businesses to pay off the loan early without additional fees.

![Shopify vs. Magento 2: Comparison Guide [+Bonus Inside]](https://ecommerce.bantenraya.com/wp-content/uploads/2025/10/Magento-vs-Shopify-img-1-large-120x86.png)