Comparing Ecommerce Loans: Shopify vs. Stripe Capital sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As we delve into the differences between these two prominent loan providers, a world of possibilities and considerations unfolds.

Introduction

Ecommerce loans play a crucial role in helping businesses grow and expand their online presence. These financial tools provide merchants with the necessary capital to invest in inventory, marketing, technology upgrades, and other essential aspects of their operations. When it comes to choosing a loan provider for Ecommerce ventures, two popular options are Shopify and Stripe Capital, each with its own set of features and benefits.

Key Differences Between Shopify and Stripe Capital

Both Shopify and Stripe Capital offer Ecommerce loans, but they differ in terms of eligibility criteria, loan amounts, repayment terms, and application processes. Here are some key differences between the two loan providers:

- Eligibility: Shopify requires merchants to have an active online store on their platform, while Stripe Capital considers a business's Stripe payment processing history.

- Loan Amounts: Shopify offers loans ranging from $200 to $1,000,000, whereas Stripe Capital provides loans based on a business's processing volume.

- Repayment Terms: Shopify's loans have fixed repayment amounts, while Stripe Capital deducts a percentage of daily sales until the loan is repaid.

- Application Process: Shopify's loan application is integrated into its platform, making it seamless for merchants, whereas Stripe Capital requires a separate application process.

Choosing the Right Loan Provider for Ecommerce Ventures

Selecting the right loan provider is essential for the success of an Ecommerce venture. It is important to consider factors such as the loan amount needed, repayment terms, eligibility requirements, and the overall fit with the business's financial goals. By carefully evaluating the differences between Shopify and Stripe Capital, merchants can make an informed decision that aligns with their specific needs and objectives.

Loan Options

When it comes to ecommerce loans, both Shopify and Stripe Capital offer different types of financing options to help businesses grow and thrive. Let's compare the loan options provided by each platform, along with the eligibility criteria and application process.

Shopify

- Shopify offers merchant cash advances as a loan option, which allows businesses to receive a lump sum of cash in exchange for a percentage of future sales.

- Eligibility criteria for a Shopify loan may vary, but typically require a minimum monthly revenue threshold and a certain amount of time in business.

- The application process for a loan through Shopify is relatively straightforward and can be done online through the platform's dashboard. Businesses will need to provide financial information and sales data for review.

Stripe Capital

- Stripe Capital offers revenue-based financing to eligible businesses, where repayment is based on a percentage of daily sales processed through the Stripe payment platform.

- Eligibility for a loan from Stripe Capital is based on the volume of sales processed through Stripe and the business's history of payments and chargebacks.

- Applying for a loan with Stripe Capital involves a streamlined process integrated into the Stripe dashboard, where businesses can easily request funding and receive approval within a short timeframe.

Loan Terms

When comparing ecommerce loans from Shopify and Stripe Capital, it is essential to consider the loan terms offered by each provider. This includes interest rates, repayment terms, and any additional fees or charges associated with the loans.

Interest Rates

Shopify offers fixed interest rates starting at 8% for their loans, while Stripe Capital provides loans with interest rates that vary based on the amount borrowed and the business's sales history.

Repayment Terms and Schedules

Shopify offers flexible repayment terms ranging from 12 to 24 months, with daily or weekly repayment schedules. On the other hand, Stripe Capital offers automatic deductions from daily sales until the loan is repaid in full, making the repayment process seamless for businesses.

Additional Fees or Charges

Shopify does not charge any origination fees or prepayment penalties for their loans. However, Stripe Capital may have additional fees depending on the loan amount and terms. It is important for borrowers to carefully review and understand any potential fees before accepting a loan offer.

Funding Speed and Limits

When it comes to funding speed and limits, both Shopify and Stripe Capital offer quick access to funds with varying maximum loan amounts.

Funding Speed

- Shopify: Shopify typically disburses funds within a few business days after approval, providing a relatively fast turnaround time for businesses in need of capital.

- Stripe Capital: Stripe Capital is known for its rapid funding process, with funds often being deposited into the business's account within 24 hours of approval.

Loan Limits

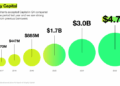

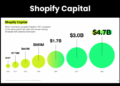

- Shopify: Shopify offers loan amounts ranging from $200 to $1,000,000, allowing businesses to access the capital they need based on their specific requirements.

- Stripe Capital: Stripe Capital provides loan amounts up to $500,000, enabling businesses to secure significant funding to support their growth and operational needs.

Utilization of Funds

Both Shopify and Stripe Capital loans can be utilized for various purposes, such as:

- Inventory purchases to meet customer demand and expand product offerings.

- Marketing initiatives to reach a wider audience and drive sales growth.

- Equipment upgrades to enhance operational efficiency and productivity.

- Hiring additional staff to support business expansion and improve customer service.

Customer Support

When it comes to choosing an ecommerce loan provider, the level of customer support offered can make a significant difference in the overall experience. Let's compare the customer support services provided by Shopify and Stripe Capital to help you make an informed decision.

Shopify

- Shopify is known for its excellent customer support services, offering 24/7 assistance through various channels such as live chat, email, and phone support.

- Businesses have reported positive experiences with Shopify's customer support team, praising their responsiveness and helpfulness in resolving issues.

- Shopify also provides a wealth of resources for loan assistance and guidance, including detailed FAQs, video tutorials, and community forums where users can seek advice from fellow merchants.

Stripe Capital

- Stripe Capital also offers reliable customer support, although it may not be available 24/7 like Shopify. However, businesses have found their support team to be knowledgeable and efficient in addressing queries.

- Customers have appreciated the personalized assistance provided by Stripe Capital's support team, with many noting quick response times and clear communication.

- Similar to Shopify, Stripe Capital provides resources for loan assistance and guidance, such as informative articles, case studies, and access to financial experts for consultation.

Final Wrap-Up

In conclusion, the comparison between Shopify and Stripe Capital illuminates the nuances of Ecommerce loans, guiding businesses towards informed decisions and successful ventures.

Query Resolution

What are the main differences between Shopify and Stripe Capital loan options?

Shopify mainly offers merchant cash advances, while Stripe Capital focuses on revenue-based financing, catering to different business needs.

How fast can businesses expect to receive funds from Shopify and Stripe Capital?

Shopify typically disburses funds within a few days, whereas Stripe Capital prides itself on faster funding, often within 24 hours.

Are there any hidden fees associated with loans from Shopify and Stripe Capital?

While Shopify has no hidden fees, Stripe Capital may have additional charges like origination fees or application fees depending on the loan.

![Shopify vs. Magento 2: Comparison Guide [+Bonus Inside]](https://ecommerce.bantenraya.com/wp-content/uploads/2025/10/Magento-vs-Shopify-img-1-large-120x86.png)